Growth of Extrusion Snack Food Market In India

The India Snacks Market will be more than INR 1 Billion by the End of 2024.

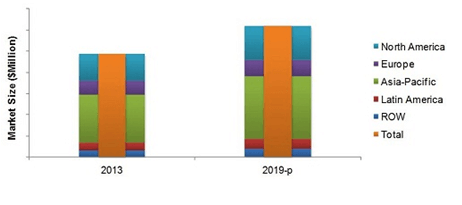

The Indian snack market is growing at 25% CAGR. The market in 2020 is estimated to be around Rs. 15000 crore as the market was 8000 crore in 2013. The CAGR during 2016 – 2021 is expected to grow more than 11%. The extruded snacks market is positively influenced by growth of retail industry and it stood at $600 billion in 2015 is projected to grow more than 8% in the coming years.

The market is divided in to three major segments:

- Chips

- Extruded snack

Traditional snacks and each carry equal share in the total market. The extruded snacks market is driven by consumption habits of consumers, marketing strategies of companies, pricing strategies and developing economies of the world. The snack market worth all over the world is given by the chart below:

Extruded Snack Market, By Geography 2013- 2019 ($ millions)

Few Players in the Healthy Snacks Market

- Snackible

- Supa Star

- OrgTree

- Snackit

- Poshtick

- WIMWI Foods

- The Green Snack Go

“Kids and young people are the primary buyers of extruded snacks and they are also the target customer segments for the main players operating in the market.Major players operating in India extruded snacks market include PepsiCo, Prataap Snacks, ITC, Balaji and Bikanerwala.”

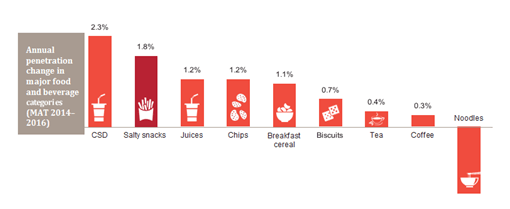

The annual consumption penetration change is clearly reflected in this

chart below:

Indian Snacks Market Companies

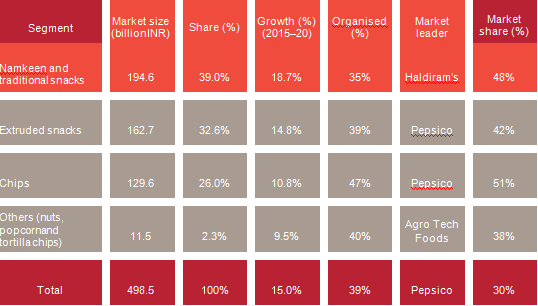

- Namkeen has the Highest Market Share in India Snacks Market.

- PepsiCo India is a Leading Player in the India Snacks Market

The various segments and its contributions to the Indian Economy is clearly given below:

The findings clearly indicate that large part of the market is unorganized. 61% of the market is unorganized which clearly means that consumers prefer local items and snacks rather than branded products in the market.

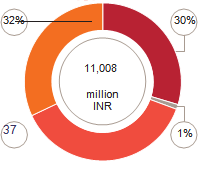

The current trends also reveals that north India has a major share of the total market with 32% and followed by western India which has a market share of 30% & both south, east have 19% market presence each in this country.

Distribution Channels and Implications

75% of the total distribution to consumers happens through independent grocers. 10% is done through supermarkets. 7% is done through hypermarkets, 5% by other retailers and 3% by convenience stores in India.

Driving factors for Future growth of this Industry:

- India is the second most populated country in the world. 65% of the total population is below the age of 30 years. The young population is expected to be the consumers for these products.

- Raising per capita income of people is another major factor which could drive to growth in this industry

- Availability of cheaper products with varieties

- Improvements in supply chain procedures

Investment Deals in various sectors in India in 2017

- The investments in various segments in 2017 are to the extent of Rs.11,008 million. The largest deal in Food and beverages accounted for Rs. 1700 million INR.

- Consumer services: 32%

- Apparel and retail : 37%

- Personal care : 1%

- Food and Beverages : 30%

The consumers are observed to be preferable from traditional snacks to western snacks of regional, national brands. PepsiCo, ITC, Parle, Prataap Snacks, Balaji Wafers, Haldiram are some leading existing players in Extruded and Chips Snacks Market.

Conclusion:

With the younger population needs and wants diversified & surplus income, discretionary income of people growing in this country, this industry would grow leaps and bounds in the future.